For most people, thinking about cost-of-living expense ratios is about as fun as reliving their root canal. But when it comes to keeping yourself on budget each month, they’re one of those necessary evils that need to at least be understood.

One of the easy points of confusion that I want to discuss here is the difference between gross income and net income and how a variance in these two numbers can have a sizeable impact on what’s actually affordable each month.

The Basics

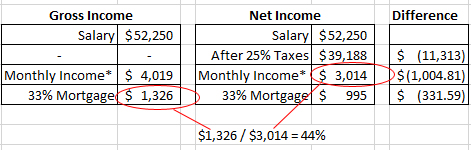

Gross income is what you make before taxes, social security, medicare and other withholdings. In the US, this equates to a median family income^ of $52,250 or $4,019 per month*.

Net income, on the other hand, is what your employer actually deposits into your bank account every other week — after taxes, social security, medicare, etc. have all been taken out. Considering the previously stated median income, this would put you the 25% tax bracket and give you roughly $39,188 per year or $3,014 per month*.

How does this difference effect cost-of-living expenses? Most significantly in our rent or mortgage payments.

A Tricky Numbers Game

In my experience, it’s standard practice that rental offices and mortgage lenders allow monthly rent/mortgage payments to equal up to 33% of your gross income. Using the median household income above, that means they’ll let you pay $1,326 each month. Unless you live in NYC or San Francisco, you should be able to find a pretty nice place with that, right?

The problem, though, is that $1,326 per month is equal to 44% of your net income a.k.a. the bacon you’re actually bringing home each month! And that’s a big chunk of your paycheck to have tied up in one expense. Here’s the math on it:

You can see in this image the difference in an “affordable” monthly payment when calculated on gross vs. net income is over $330. If you’re a single-income home, have kids, can’t seem to save for retirement or wish you could go on vacation more often…$320 a month can make a pretty big difference when planning your monthly budget.

Living Conservatively

If you’re currently in an apartment and feel like rent is getting a little too high, check this ratio for reference. It’s not easy to do, but it could be time to give up the prime location or the granite counter tops and stainless steel appliances to be able to have a little more cushion in the budget and put money toward savings.

If you’re looking to buy a home anytime soon, please take this ratio into consideration. I feel like the No-Fun Police when my wife shows me homes on Zillow and I have to agree that it’s an awesome house, but a little out of our price range given our currently saved down payment and affordable monthly (net income) payment.

And if you’re already a homeowner and feel like things are a bit more of a pinch than you thought they’d be, this could be one of the reasons why. If you plan on moving in the future, keep these numbers in mind (or see what you can do to raise your income enough to get your ratio back in your favor).

Remember: Just because a landlord or mortgage lender is willing to let you put a certain amount of your money in their hands each month doesn’t mean you have to (they’re so generous aren’t they?). We don’t have to spend 33% of our net income on our monthly payment. If fact, you could go super conservative and shoot for Dave Ramsey’s suggestion to stay at 25% because it frees your money up for so many different things.

A Tough Balance

Is keeping your monthly housing payment low an easy thing? Definitely not. My wife and I’s current rent takes up 29% of our budget (which I’m happy with) but we’re not obsessed with where we live. There’s not a lot of natural light, the kitchen is a little smaller than we’d like and we have two random pillars in our living room that I still haven’t figured out a functional purpose for…but the freedom that comes in other areas of our lives because we’re disciplined in our finances is well worth the “imperfect” temporary living space.

In my next post, we’ll look further into the long-term implications of various mortgage decisions (and I promise it’s good stuff worth sticking around for!). But until then, have you ever struggled to find the balance between finding a decent place to live and keeping your monthly payment in check? What trade offs did you have to make?

^http://www.deptofnumbers.com/income/us/

*Based on receiving 26 paychecks per year, assuming two pay checks per month and does not take into account the two months per year that you would receive three pay checks (which always feel like a bonus, don’t they?!)