Pop quiz. How would you answer the following question?

When an unexpected vehicle breakdown, water heater blow-out or other major life event occurs, costing $1,500, I will:

- Put myself on a payment plan with the repair company/my credit card

- Pay for it in cash and be done with it

- Move to a bungalow in Mexico because I can’t handle another financial issue right now

The reason most financial emergencies cause stress is that there are no means by which to handle them – they’ll stretch an already thin budget to its brink.

The best way to avoid this is to start building an emergency fund.

The Reality

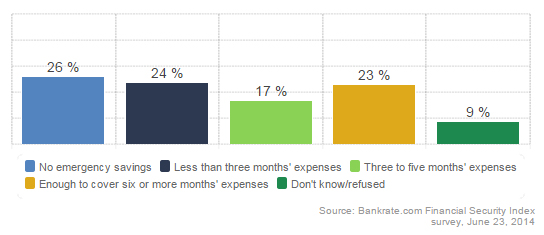

Twenty six percent of people have no emergency fund in the US. In total, 67% of people have less than six months of expenses saved.

This means, when an emergency strikes or a job is lost, the heat from the kitchen gets real hot real fast.

How different would it feel if there were $1,000 in the bank? What about $2,500? Maybe $10,000? All of a sudden, the need to create more payments in times of emergency disappears. It hurts a little to see that money go, but now our budget just has to be adjusted to replenish money in a personal savings account — that monthly budget line item doesn’t have to be dealt out to some other person taking your money.

Defining an Emergency

The important thing to remember is that the last-minute opportunity to go on vacation with friends for $1,000 does not constitute an emergency. Nor does needing a new wardrobe for the spring season when you learn that Aquamarine is the “it” 2015 Pantone color (it is, you know). Those are wants, not needs.

Emergencies should deal only with things that keep you safe, healthy and afloat: i.e. a car to get you to work, a home foundation that needs repaired or medical bills after a freak accident. You don’t want to have to use the money, but life happens to people every day, so having it on hand is a must.

It’s About Peace of Mind

It’s often said that money can’t buy you happiness, and the truth is, an emergency fund won’t do that. What it should do is become an asset that provides peace of mind where (oftentimes) stress wins the day.

Total Money Makeover recommends starting with $1,000. Long-term, most financial experts recommend having three to six months of expenses set aside. This way, even if a job is lost, the mortgage, utilities and groceries are all covered. What a relief!

So take a look at that monthly budget and see if there’s any room to start creating (or continuing to build) an emergency fund. It should be a specific amount of money set aside in every month’s budget. It takes time, but the peace of mind that follows is worth the effort.